The 2019/2020 Federal Budget sees the Government predicting a return to a surplus of $7.1 billion.

Driven by the politics of a looming election, the Government is lowering taxes and increasing spending with a focus on low/middle income earners, small business, senior Australians and transport infrastructure.

Here is a summary the key measures announced:

- Surplus Budget – a Budget Surplus of $7.1 billion has been announced after more than a decade. Govt estimates indicate surpluses over the next 4 years also and forecasting the economy to grow by 2.75% in 2019 – 20 and 2020 – 21.

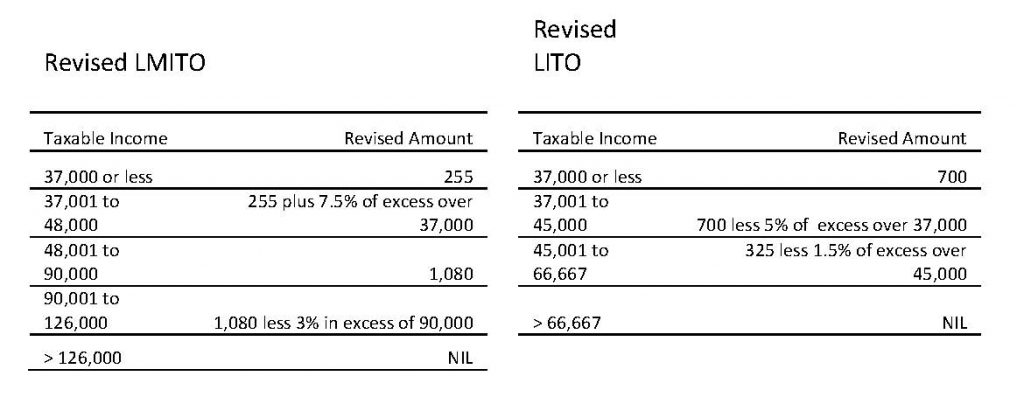

- Increase to Low- and Middle-Income Tax Offset (LMITO) and Low-Income Tax Offset (LITO) – The amount of LMITO has been more than doubled and new slabs adding $255 to $1080 in the pockets of taxpayers based on their Taxable Income. The amount of LITO has also been revised to $700 as compared to $445 currently.

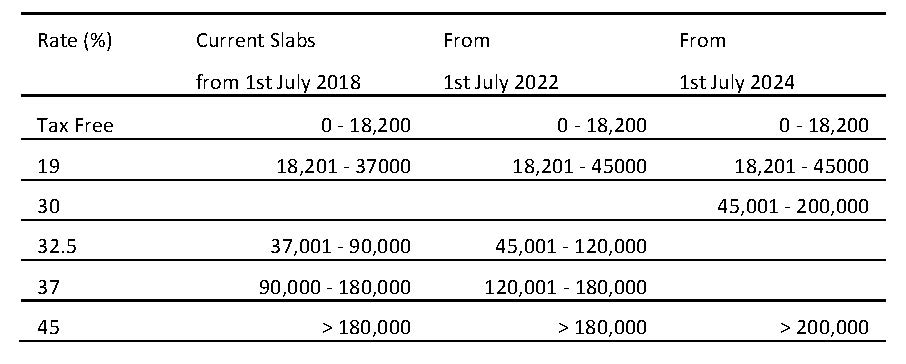

- Change to the personal income tax brackets – It has been proposed to gradually raise the income tax brackets and eventually reaching to a point where there would be only 3 personal income tax brackets of 19%, 30% and 45%.

- One-off Energy Assistance payments of $75 for eligible singles and $125 for couples.

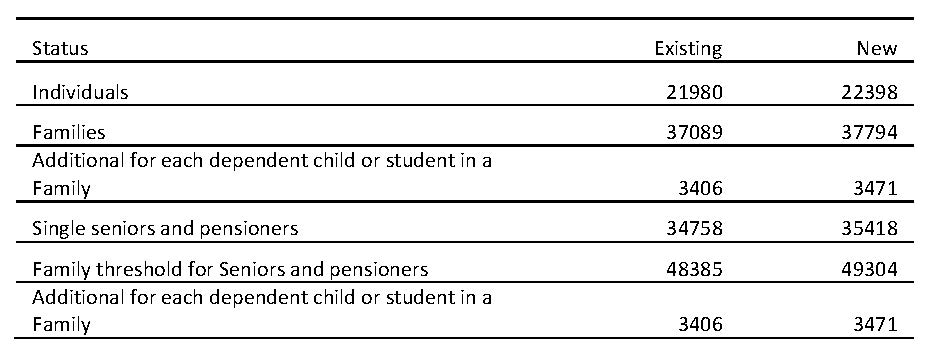

- Increase in Medical Levy Low–Income Threshold

- Deferral of Deemed Dividend (Division 7A) Rules until 1st July 2020 allowing more time to private businesses to correct their cash flows.

- Instant asset write-off limit increased from $25,000 to $30,000 with the annual turnover limit qualifying for this benefit increased from $10 Million to $ 50 Million.

- Superannuation benefits

-

- Removal of work test requirement

- Extension of bring-forward arrangements

- Increase in age limit for Spouse contributions from 69 to 74 years.

- Insurance within Superannuation for young members

- Streamlining requirements for calculation of exempt current pension income for Superannuation Funds

- More funds to ATO to enable electronic refund request under a number of superannuation arrangements

- Minor amendments to hybrid mismatch rules.

- Luxury Car Tax relief for farmers and tourism operators.

- More export incentives.

- Extra funding to ATO and DVA to support the expansion of data collected through STP by the ATO and use of this data by Commonwealth agencies.

- Curb on Sham-contracting through a dedicated sham contracting unit within Fair Work Ombudsman.

- $1 Billion funds to ATO to operate Tax Avoidance Taskforce.

- More funds to ASIC and APRA to implement Royal Banking Commission measures.

- Curbs on Black economy through strengthening of the ABN system.

References

PwC’s Federal Budget Insights

Thomson Reuters weekly tax bulletin Issue no. 14, 2 April 2019

For all media enquires please contact Tracy Miller, CMO, Keeping Company 0414 898 452.